The Significant Impact of the Pandemic on The Stock Market

The COVID-19 pandemic, which began in late 2019, has had a significant impact on the global economy and financial markets, including the stock market. In this essay, we will discuss the impact of the pandemic on the stock market and how it has affected investors worldwide.

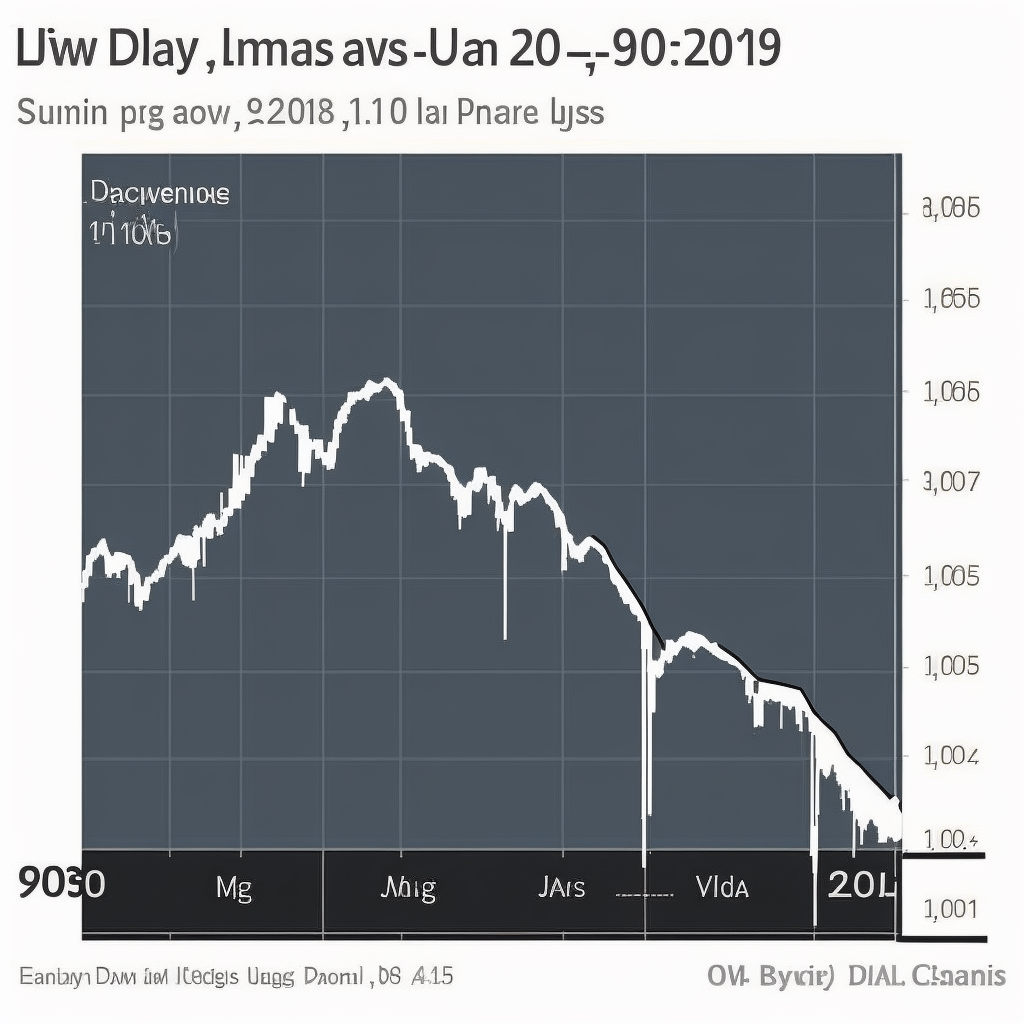

The stock market is a barometer of the overall health of the economy. As such, it is often a leading indicator of economic trends. In the early months of 2020, as the pandemic began to spread rapidly, stock markets around the world experienced a sharp decline. The Dow Jones Industrial Average, for example, fell by 1,000 points in a single day in February, marking the worst one-day drop since 2011.

The pandemic had several impacts on the stock market. First, it disrupted global supply chains, causing a decrease in production and a subsequent decrease in demand for goods and services. This led to a drop in the value of many companies’ stocks, particularly those in industries such as travel, hospitality, and retail.

Second, the pandemic led to a decrease in consumer spending as people stayed home to avoid infection. This had a ripple effect on the broader economy, as consumer spending accounts for a significant portion of economic activity. As a result, companies that rely on consumer spending, such as retailers and restaurants, saw their stock prices decline.

Third, the pandemic had a profound impact on the energy industry. With fewer people traveling and using cars, the demand for oil dropped, causing a significant decline in oil prices. This had a ripple effect on the energy sector, causing a decline in the value of energy companies’ stocks.

Finally, the pandemic led to widespread uncertainty and panic among investors. As the number of cases and deaths increased, investors became increasingly concerned about the impact of the pandemic on the economy and financial markets. This led to a sell-off in the stock market, with investors rushing to sell their stocks and reduce their exposure to risk.

However, it is worth noting that the pandemic also had some positive impacts on the stock market. For example, it led to a surge in demand for technology companies, as people began to rely more on digital communication and remote working. As a result, tech companies such as Amazon, Apple, and Microsoft saw their stock prices increase.

Additionally, the pandemic led to a decrease in interest rates, as central banks around the world implemented monetary policies to support the economy. This made borrowing cheaper for companies, which led to an increase in stock prices for some companies.

In summary, the COVID-19 pandemic had a significant impact on the stock market, causing widespread volatility and uncertainty. The pandemic disrupted global supply chains, decreased consumer spending, and had a profound impact on the energy industry. However, it also led to a surge in demand for technology companies and a decrease in interest rates, which had positive impacts on some companies’ stock prices. As the pandemic continues to evolve, it remains to be seen what the long-term impacts will be on the stock market and the broader economy.